The information, analysis, and opinions expressed herein are for general and educational purposes only. Nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. All investments carry a certain risk, and there is no assurance that an investment will provide positive performance over any period of time. The asset classes and/or investment strategies described may not be suitable for all investors and investors should consult with an investment advisor to determine the appropriate investment vehicle. Investment decisions should always be made based on the investor's specific financial needs and objectives, goals, time horizon and risk tolerance. The statements herein are based upon the opinions of Envestnet and third-party sources. Information obtained from third party resources are believed to be reliable but not guaranteed.

The graphical illustrations do not represent any client information or actual investments; they are not being offered to assist any person in making his or her own decisions as to which securities to buy, sell, or when to buy or sell. Investors should note that income from investments, if any, may fluctuate and that price or value of securities and investments may increase or decrease. Accordingly, investors may lose some or all of the value of principal initially invested. Past performance is not a guarantee of future results.

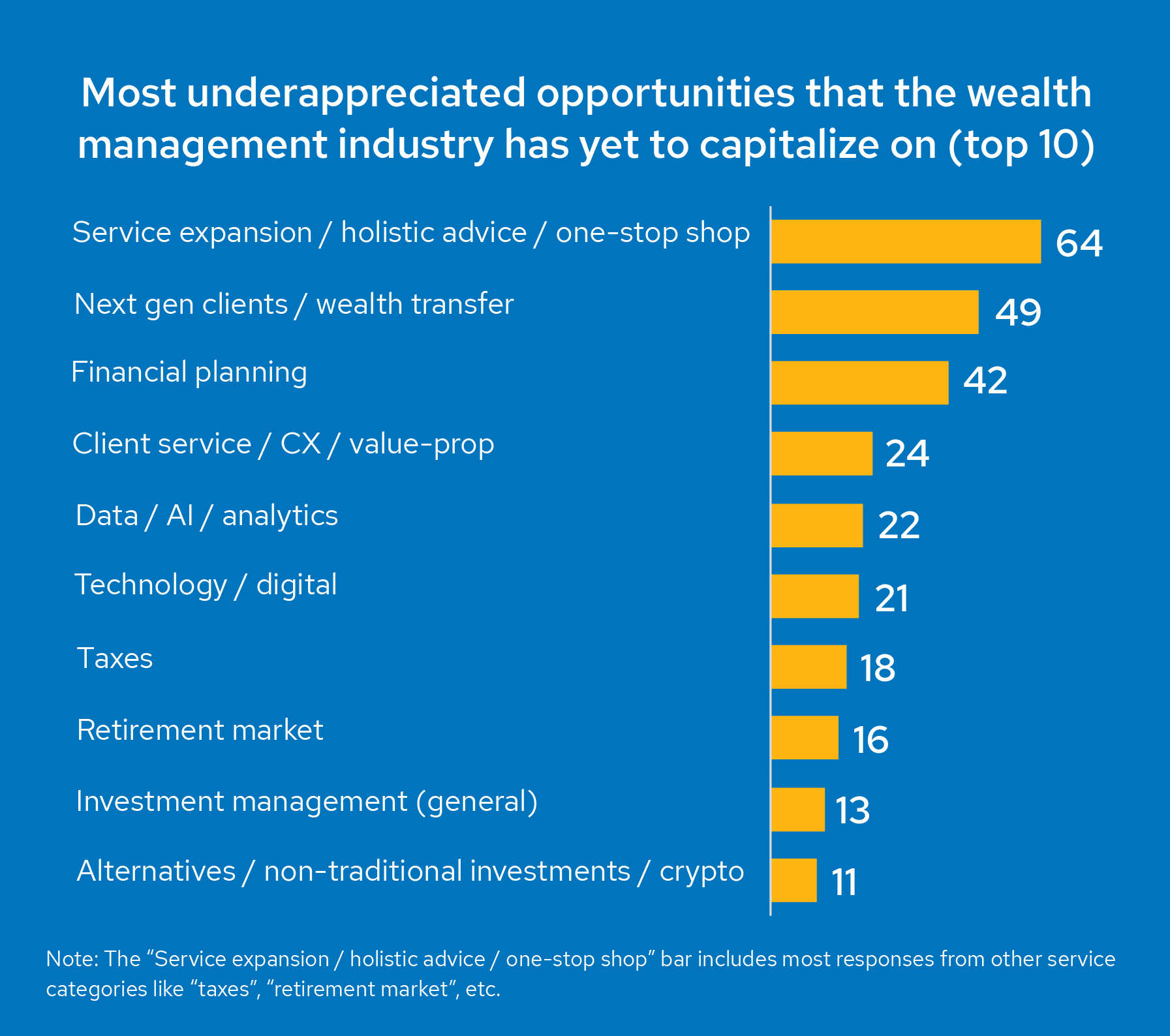

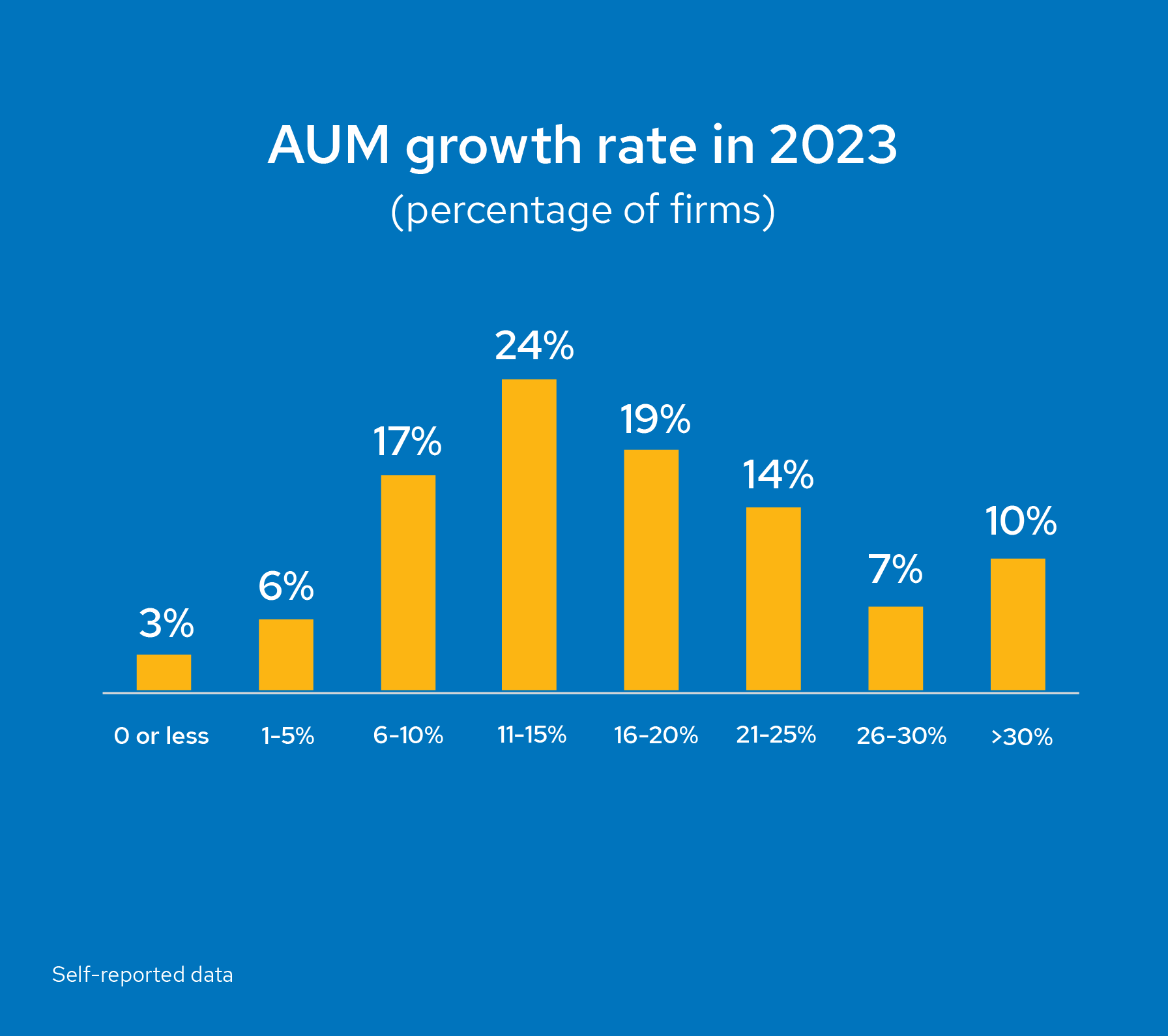

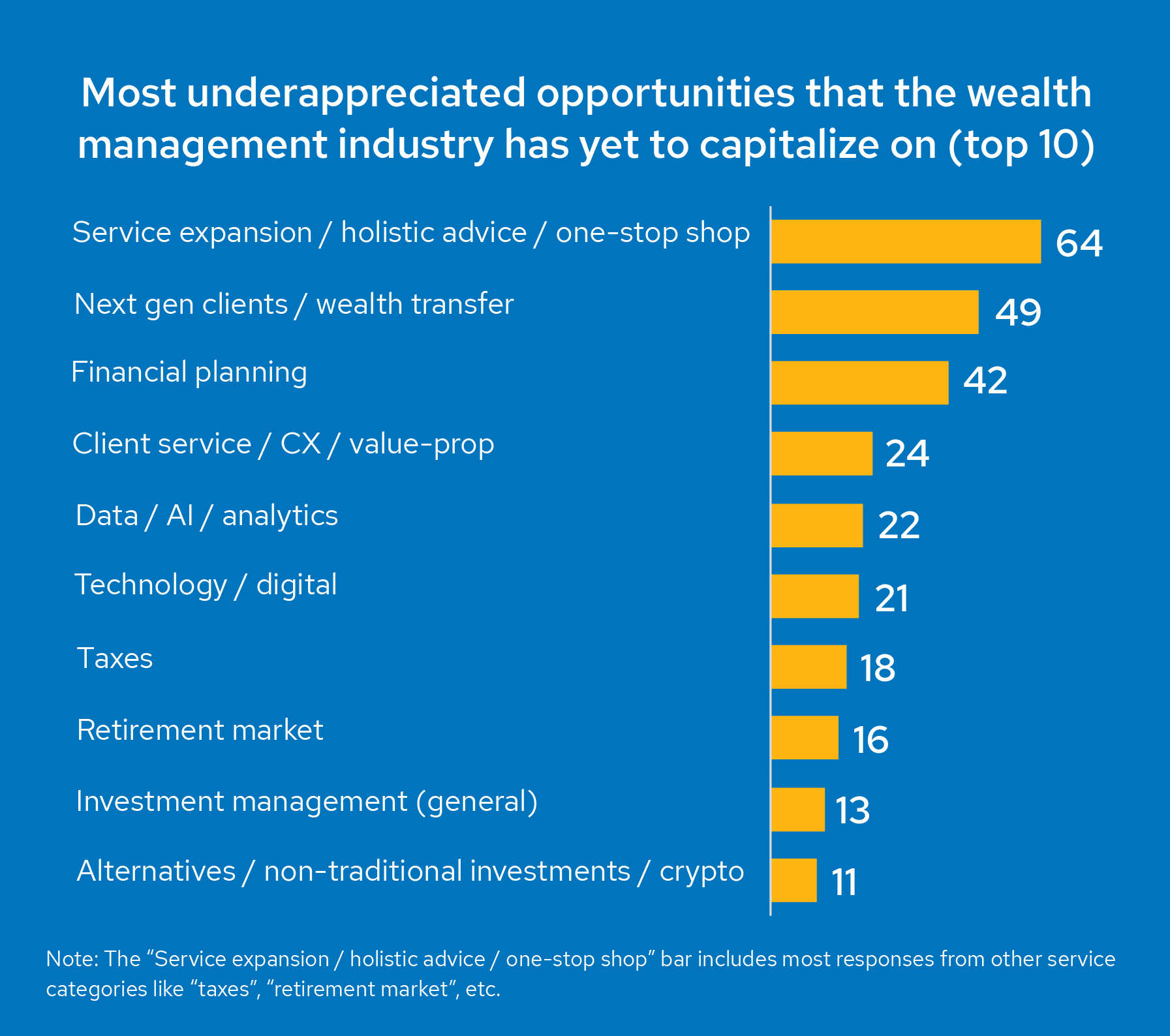

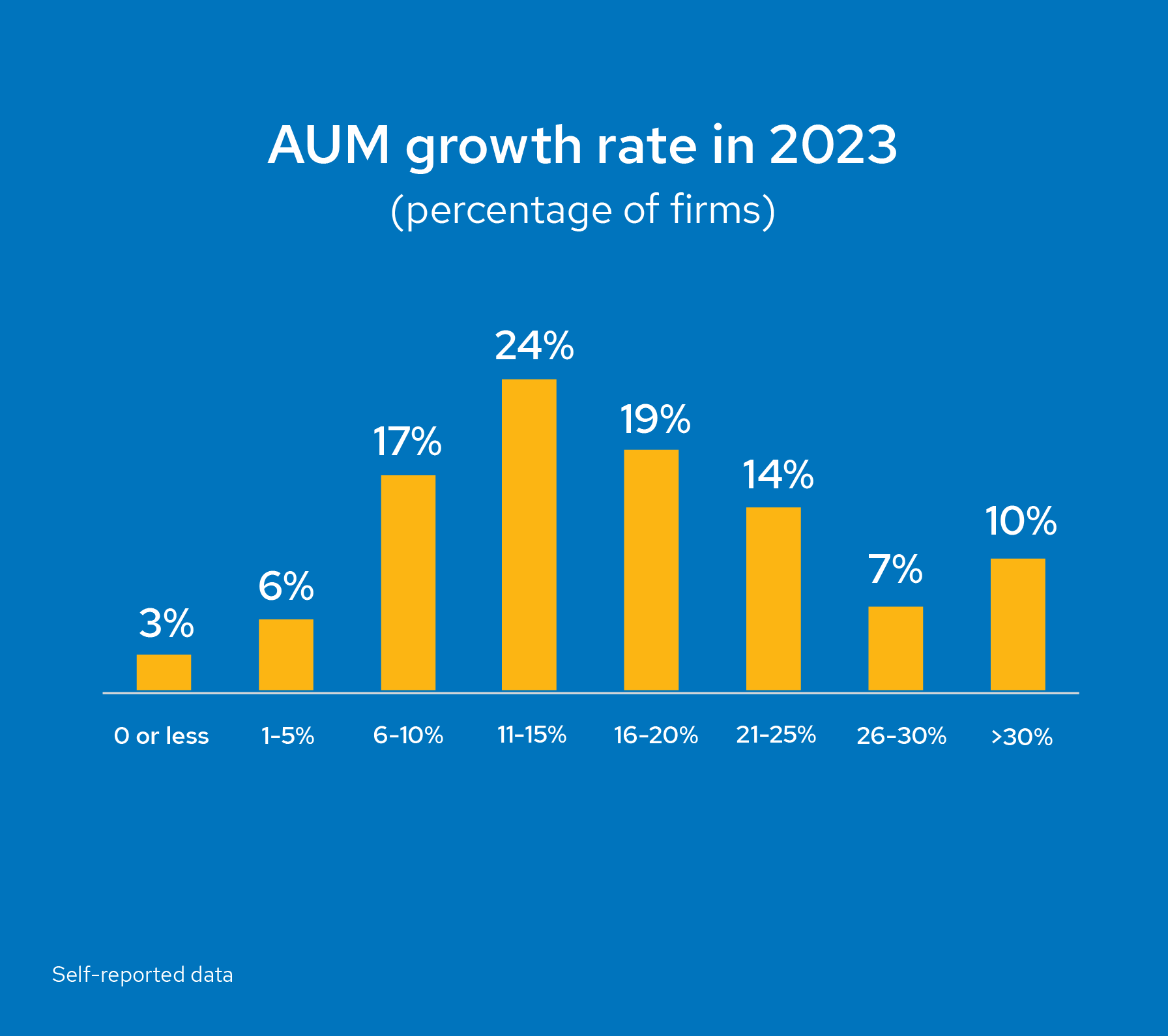

In early 2024, Envestnet’s Market Intelligence team conducted a survey of financial advisors, yielding 290 responses that were deemed appropriate for analysis. The results of this survey may not be representative of all financial advisors.

©2024 Envestnet. All rights reserved.